Key Features and Benefits 22

Multiple Trusts

Why use Multiple Trusts?

Setting up a Trust is a flexible way of giving away assets without passing them absolutely to Beneficiaries.

In an effort to reduce the occurrence of periodic and exit charges we have always advised the use of Multiple Trusts settled (signed ) on different days. And so becoming non related settlements under section 62 IHTA 1984.

There are many other reasons to consider Multiple Trusts as below:

-

Privacy

Whereas a Will is a public document that anyone can request a copy of once it has been admitted to probate, Trusts are semi secret documents for the eyes of the Trustees alone. The Trust is a private document, and the contents of it will not become public. Who you have chosen to benefit from your Estate will therefore remain private.

-

Different Beneficiaries

You can name different Beneficiaries in different Trusts. This will ensure privacy and separation for all parties, as the Beneficiaries of a Trust will not be involved in the use of funds for any other if they are not parties to the settlement.

-

Autonomy & Management

You can appoint different Trustees to different Trusts if desired. This means that control and decision making powers can be in the hands of different people for different Trusts. Trustees must act unanimously, and this can become an issue where there are disputes between the Trustees and they no longer see eye to eye. Trusts can no longer operate effectively if the Trustees cannot agree on a course of action, and it may be that the funds cannot be utilised for the benefit of Beneficiaries as a result. Allowing different Trustees to act across a number of Trusts means that each Trust can be managed independently of others. This once again allows privacy and separation for the Trustees of each Trust.

-

Divorce

Where a Beneficiary of a Trust gets divorced, any benefits they have received from a family trust may be taken into account in a settlement. If the Beneficiary can benefit from a number of Family Trusts but to date has only received a benefit from one Trust, for example, it is likely that only the Trust they have received a benefit from so far is at risk of being included in any settlement. Any Trust or Trusts that a Beneficiary has not received a benefit from to date may not be included in a settlement, as they have not yet received anything from the Trust. This can be a way of better protecting the assets, as the increased separation reduces the risk of attack.

-

Costs

Where the Trustees of a Trust are concerned with one Family or branch of the family as opposed to numerous members with different needs, the management of the Trust can be simpler, and therefore cheaper. A group of simple Trusts is much simpler to manage than a single Trust with many purposes, mixed assets, multiple Beneficiaries and more potential for conflict amongst them.

The payment of periodic and exit charges is small compared to the potential 40% Inheritance Tax payable if the assets are in the estate of your Beneficiaries.

How many Trusts do I need?

There is no limit as to how many Trusts can be created. Ideally, you want to create as many Trusts as you require for each significant asset or purpose.

Current legislation (section 144 IHTA 1984) allows one to use close family members (probably children and grandchildren) to change the Discretionary Trusts settled by a Will to Interest in Possession Trusts. Interest in Possession Trusts do not generate periodic or exit charges. We can then change the Interest in Possession Trusts into Relevant Property Trusts. These changes can be done on different days so the Relevant Property Trusts are not related settlements under the new Section 62A contained in the Finance Act 2015.

The work above (using Section 144) is best done post death. It is therefore best practice to appoint us as the Executors and Trustees of the Trust to ensure that the required work is done correctly and in an appropriate time scale.

The work is best done post death as only at that time will we fully understand exactly how many close relatives the client has and who are the most appropriate close relatives to use in giving the Interest in Possession on the Discretionary Trusts established by the Will.

Example

Mum and dad purchase a £100K house for son to live in while at university in 2005. Mum and dad are on Land Registry Title, son lives there for 10 years. Parents decide to sell the house in 2015 for £300K.

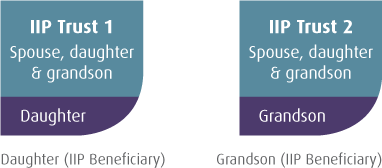

Settled from the Will

Mr Smith leaves a legacy equally to two Family Trusts of the NRB for the benefit of his spouse, daughter and grandchild. This in the future may included the additional NRB.

After Death

Use section 144 of IHTA to give an Interest in Possession to other children or grandchildren in each of the Trusts.

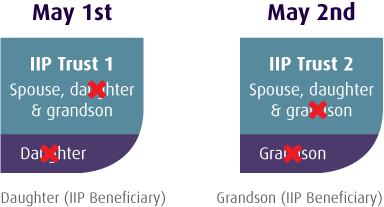

Later

The date the Interest in Possession is taken away is the date the Trust enters the relevant property regime and is then liable to periodic and exit charges. As the dates these changes are made are different for each Trust then they are not related under section 62A IHTA 1986.

This sheet contains only general planning and is not to be construed as advice for any personal planning. Each strategy recommended is based on individual circumstances.

Brand this sheet with your company Logo and your company colours

Become a Countrywide member and our Marketing team can brand this document for your company. We can add your company logo, change the heading colours and add your contact details to the back for just £10 + VAT per Key Features and Benefits or Client Support Information sheet Press here to see an example of a branded Key Features and Benefits Sheet.

Join Countrywide to access and print this document as well as many others.